Aluminum Pricing Outlook – China

China – Aluminum Update

Price:

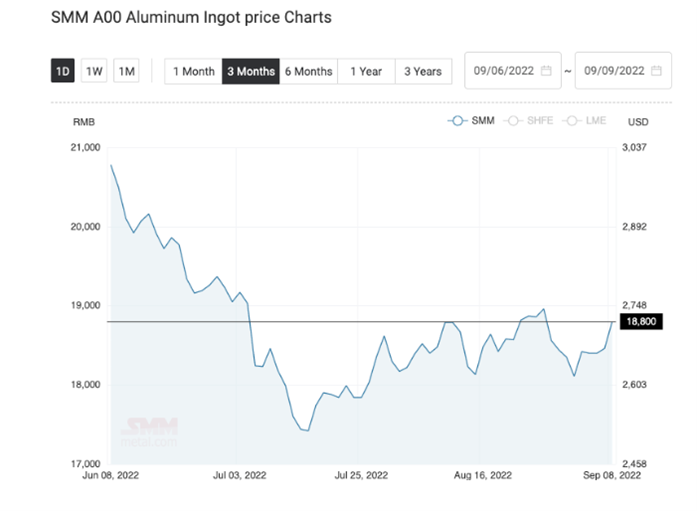

RM prices have softened a bit in China due to the lockdown and lower demand for housing. Pricing outlook for the rest of 2022 and 2023 remains robust – Last 90 days have seen a reduction of about 9% but the end of the year is likely to be around 21000 RMB / Ton. However, X-rate has strengthened so the net price should remain stable within +/- 7%.

Capacity / Production:

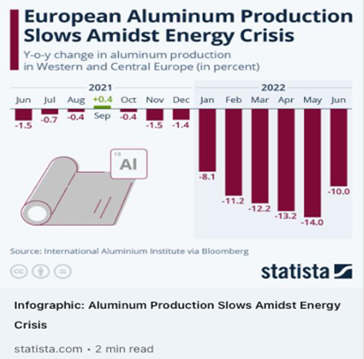

China’s Aluminum production has steadily increased from 11 Million tonnes in 2011 to 38.5 Million tonnes in 2021. Beijing’s capacity cap is 45 million tonnes. In 2022, many locations are experiencing power cuts but Chinese aluminum demand is high domestically as well as abroad, especially in