How to Make Nearsourcing Manufacturing in Mexico Work for You?

Introduction

With tariffs followed by COVID, manufacturers are under all kinds of pressure to keep up production and maintain profitability while containing costs, and to do so in face of a stunted supply chain. The fact is that things are very different now than they were just five years ago. Sourcing and supply chain professionals are at a crossroads, having to evaluate the options:

• Should manufacturers continue to outsource internationally and risk long lead times and shipping delays?

• Should manufacturers adopt a nearsourcing strategy even though it may increase tooling costs

• Is there another strategy that would allow manufacturers to reap the benefits of both?

This white paper examines global outsourcing and North American near-sourcing strategies to give U.S.- based manufacturers new insights – and options – for doing manufacturing in Mexico right.

Sourcing Strategies

Sourcing professionals are being challenged by engineering and marketing teams to explore alternative options to give manufacturers competitiveness, as well as agility in development and fulfillment.

For sourcing executives of U.S.-based manufacturers, there are two choices from which to choose:

1. Nearsourcing: Produce the product in a U.S.- or Mexico-based facility.

2. Outsourcing: Send production to Asia (China, India, Vietnam, etc.).

Sourcing Has Changed

Since the pandemic, it’s become trendy to bring production back to the U.S. from Asia or, at the very least, to keep it in Mexico. Today, sourcing is marked by rising transportation costs, increased tariffs on production in China, and a push to go (or return) local. There’s an overall climate of “something’s got to change” with outsourcing, which is making it attractive for U.S.- based manufacturers to consider (or reconsider) North American sourcing.

Nearsourcing vs Outsourcing: Which is Better?

Because sourcing and supply chain professionals are facing a new paradigm, they must consider building more for flexibility and resilience rather than relying on uncontrollable geopolitical factors.

Thanks to a combination of geopolitical uncertainties, tariffs, and a global pandemic, near-sourcing has proven its worth in delivering these benefits:

- Inventory cost savings, including reduced opportunity costs, storage costs, and unsold inventory costs

- Quick response to stock-outs

- Production flexibility and lower machining costs

- Decreased transportation expenses

Outsourcing is not without its own benefits. China, India, and Vietnam offer plenty of advantages to manufacturers, especially when considering fundamental expenses, such as labor and changeover costs, speed of development, and inhouse diversification.

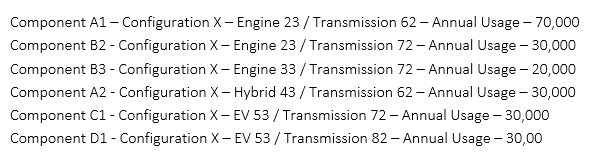

Manpower Cost for Production and Changeover

Asian countries have long had a distinct advantage over the West due to their lower cost of living. They have also built a lot of capacity in manufacturing plastic, metal, and electrical components. Wage disparities are even more significant as specializations increase. For example, while production labor difference between China / Mexico / US is $5.50 / $6 / $15, maintenance hourly labor difference is $15 / $20 / $45.

Bottom line: Asia’s labor costs are hard to beat.

In-House Diversification

If needed, many Asian suppliers, especially in China, can integrate other aspects of parts production, such as providing castings, painting, or machining.

Bottom line: Asian suppliers’ overall production costs tend to be more affordable than outsourcing subprocesses.

The Nearsourcing Advantage

When demand variance is volatile, and transportation costs are high, near sourcing offers unique and significant cost advantages.

Transportation

Global transportation costs via container or air typically add up to a significant cost chunk of the product cost (PC). However, in a regular logistics situation, these costs are almost comparable to trucking for near-sourcing options like Mexico. The bulk of these costs, of course, can be offset and even reduce simply by mixing production parts with other parts, thereby ensuring a full container.

Cost of Overage

The costs associated with excess inventory can be divided into two broad variants:

- One-time demand: In this scenario, the cost of underage/excess inventory is the cost of the product unsold or, if applicable, the cost of the product less the scrap value.

- Continuous/regular demand: Demand may vary, but it does not end. In this case, the cost of underage is calculated using such costs as inventory carrying and storage cost, along with a small probability of the product not being sold.

Advantage:

- The ability to produce smaller batches with reduced time between production and sales

Results:

- A better forecast that helps minimize overage costs

Cost of Underage

The cost associated with less inventory also can be divided into two similar scenarios:

- One-time demand/production cycle: For underage, this refers to the profit/margin loss resulting from lost demand. Depending on the industry, a goodwill loss also may be added.

- Continuous/regular demand: In this scenario, this refers to the expediting cost plus the goodwill cost.

Advantage:

- Expediting costs include production changes and local costs only

Results:

- Substantial savings on expediting costs since there are no additional air freight or container expediting costs, plus inland/local costs

Carrying Inventory and Price Comparisons

Nearsourcing shortens the time between production and sales. Unlike outsourcing, which leads to capital being locked in the inventory, near-sourcing helps free up capital.

Because of the aforementioned factors, it doesn’t make sense to only consider the production cost (PC) price. Instead, consider all the costs involved. This is known as the landed cost and is a sum of these costs: production costs, transit costs, overage costs, underage costs, and capital lock costs.

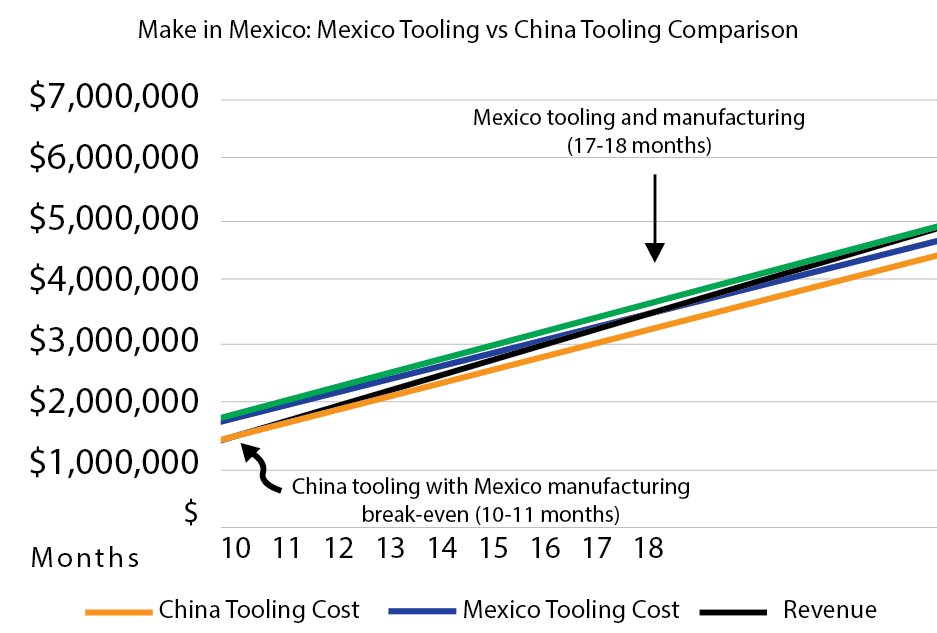

Tooling Costs

All custom components need special tooling to make components. This applies to castings, moldings, forgings, and most other manufacturing processes. Purchasing and engineering teams must launch new tooling before production can even begin. These tooling costs can be significant. Tooling skill and hourly rates for toolmakers in U.S. and Europe are very expensive, with toolmakers routinely being paid $35+ per hour rates.

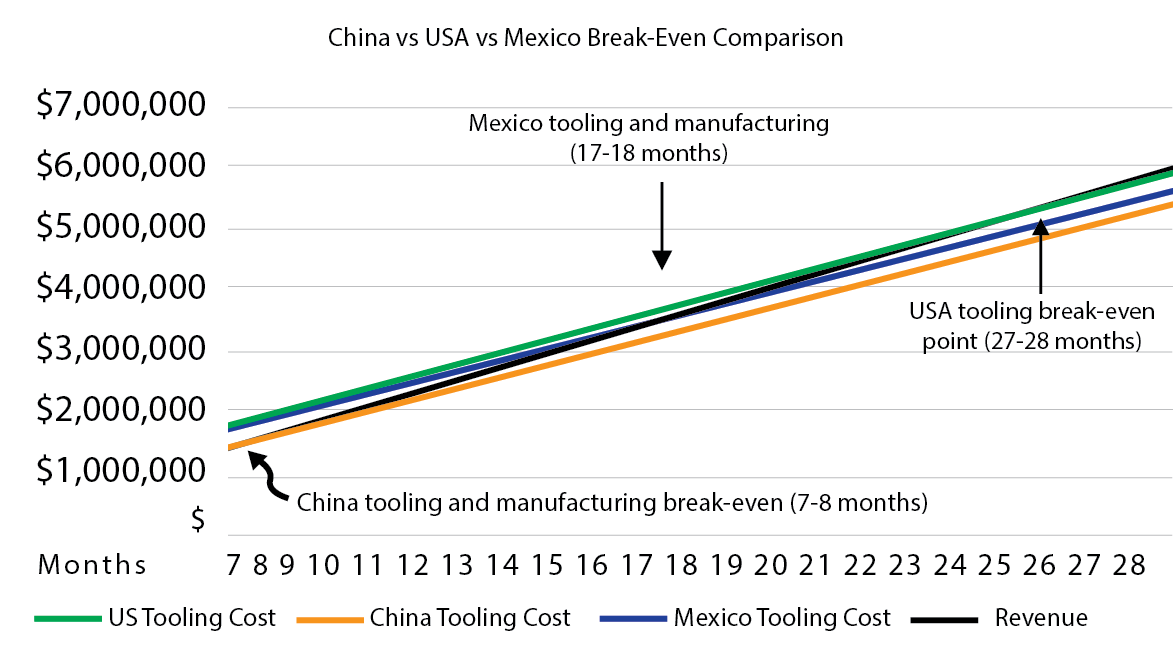

An observation of the tooling cost in North America would show those costs to be roughly 3X to 5X of the cost of tooling development in Asia. Add in longer lead times of 10-12 weeks in North America versus 6-8 weeks in China, and tooling costs are a major factor for determining both the break-even point and profitability.

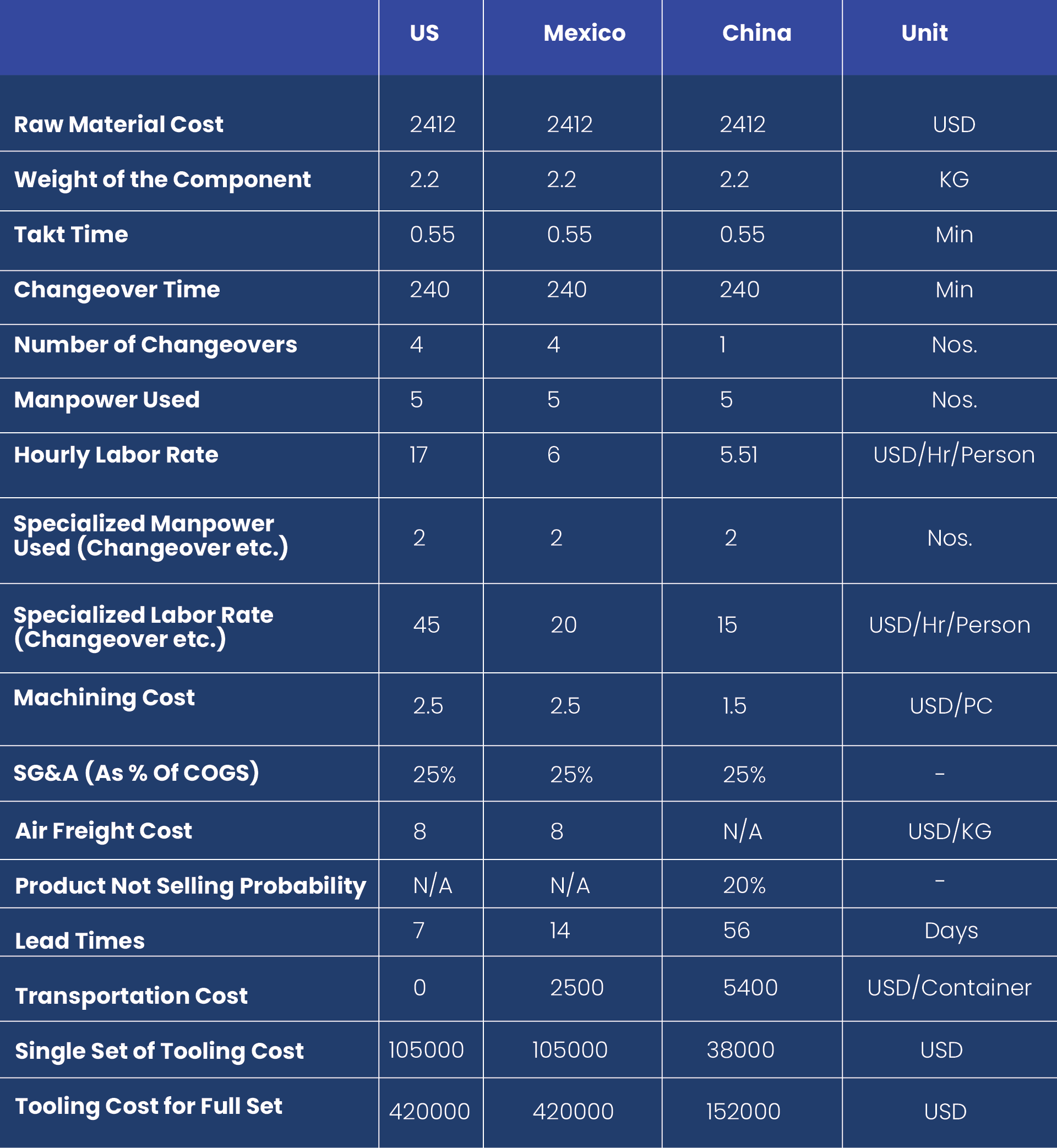

A Real-World Example: Monterrey Motors

To meet customer demand, automotive manufacturer Monterrey Motors expanded its available options. Its lineup now includes two engines, four transmissions, a hybrid, and a special electric vehicle (EV) model as evidenced by the following components: