Three Impacts of Red Sea and Panama Canal on Supply Chains

It’s all over the news right now: Safety concerns for shipping vessels in the Red Sea, drought in the Panama Canal, and economic uncertainty around the world.

Individually, each of these is enough of a concern for manufacturers, but as a whole? It’s sizing up to be the perfect storm for substantial and far-reaching supply chain disruption.

While the automotive, electrical, and lighting industries have undergone tumultuous times since the global pandemic (remember the container shortage crisis?), this unfolding drama is likely to prove even more volatile.

Worse, some manufacturers are in the dark about it, let alone prepared to tackle it. Here’s a recap of what’s happened so far, along with what can be done to build supply chain resilience in the face of it.

What’s Happening to the Supply Chain in 2024?

The short answer to the question, Is there a supply chain crisis in 2024? is an unequivocal “yes.”

The long answer is that while manufacturers are no longer flying blind as they did during the pandemic, in 2024, it’s going to take more than a wish, a hope, or a wait-and-see approach to not just survive but thrive.

To keep our cutomers’ supply chains running as smoothly as possible in 2024, we’re doing what manufacturers like you may want to do, too. We’re implementing a wide range of supply chain resiliency strategies, each designed to:

- Strengthen sourcing, logistics, and supply chain partnerships.

- Thwart and avert supply chain crises through a well-developed crisis management plan.

- Design, develop, and implement innovative mitigation tactics.

Our 2024 strategy started long before the New Year, however. In early 2023 we invested in an end-to-end tracking SaaS (Software as a Service) solution, designed to help stop the “black hole” of ocean shipment visibility. In addition to enabling improved visibility into the supply chain, our investment allows us to be even more proactive in managing shipments from origin to destination.

“When it comes to supply chain—especially in a disruptive environment like we’re seeing in 2024—visibility is mission critical. This SaaS solution uses a predictive system based on algorithms, so if a shipment isn’t where it’s supposed to be on a certain day, we can reach out to the freight forwarder to get near real-time location of the cargo,” says Eric Turner, MES Director – Global Supply Chain. “We’ve been piloting the tool for over a year now and it’s proven to be invaluable in helping us help our customers. With this tool, we’re streamlining processes, reducing the time spent manually searching for cargo, better managing supply chain risks, and identifying potential inefficiencies, all so we can realize continuous improvement on behalf of our global customers.”

This is especially important given what’s happening in global shipping. Here’s a high-level look at what’s happening in the Red Sea and with the Panama Canal.

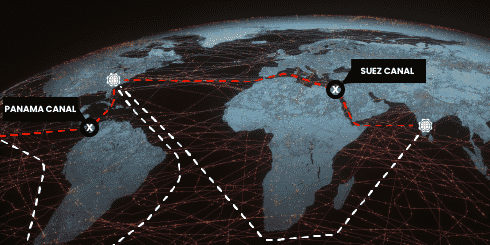

The Panama Canal

According to ForeignPolicy.com, the Panama Canal is experiencing a severe drought, “forcing Panama to let fewer ships through … (which has) led to delays, increased shipping costs, and uncertainty over the future of one of the world’s critical trade chokepoints.”

In February 2024, the United States Department of Transportation posted an update on the status of commercial cargo transits moving through the Panama Canal Authority, showing just how sharp the decline in traffic has been in the past couple of years.

The Impact of the Red Sea and Panama Canal on Supply Chains

The security concerns in the Red Sea and the drought-related restrictions in the Panama Canal are forcing transit carriers to divert ships to alternate routes, including sailing around South America.

The Trickle-Down Effect of Panama Canal, Red Sea Challenges

The trickle-down effect of these diversions and restrictions is far reaching. Here are three supply chain impacts caused by recent disruptions in the Red Sea and Panama Canal:

- Increased global freight costs.

Labor, fuel, time. There’s a lot that goes into determining the cost of shipping through some of the world’s busiest shipping lanes, which includes the Red Sea. With 12% of all global trade passing through the Red Sea—30% of which is global container traffic—it’s no wonder that costs are rising fast and furiously as access becomes more limited due to increase threats of piracy. The trade policy think tank Global Trade Research Initiative reported in January 2024 that shipping costs were going up by 40-60%. That figure is independent of rising insurance costs and surcharges, which are reported to have soared from $500 to as much as $2,500 per container.

- Longer voyage durations and delayed deliveries.

Most established shippers are experiencing a lead-time increase of 8-12 days. Smaller carriers and exporters have it even worse, with delays of nearly 40 days. These delays, of course, are a direct result of shipping traffic backing up in both the Red Sea and the Panama Canal. Adding to the problem is that these evolving and unpredictable conditions are making it difficult if not impossible to accurately predict delivery timelines.

- Tighter supplies.

Naturally, as lead-times increase, supplies for some commodities become even tighter. With the very recent collapse of Baltimore’s Francis Scott Key Bridge, conditions for importers and OEMs have deteriorated even further. The saving grace, if you can call it that, is that demand has slowed down a bit, which is helping keep inflation in check. Still, if the Panama Canal situation is not significantly improved soon, there exists a very real potential for permanent misalignment of lead-times. The result? Already tight supplies could become even more tight, creating an even bigger problem.

What’s Next?

Adding to these complexities is the fact that countermeasures, such as diversifying sourcing to move away from manufacturing in China isn’t a one-and-done solution. Rather, it could open up a plethora of compliance issues and other risks that some manufacturers may not be aware of nor experienced in.

In fact, that’s where our team of highly qualified and knowledgeable sourcing and global logistics professionals can help. At MES, we take the burden and hassle out of managing the import and export process, monitoring port conditions and shipment re-routes, as well as handling the paperwork, fees, and other customs-related requirements. Everything we do on behalf of our clients is designed to help us proactively respond to disruptions and to create and sustain a more resilient supply chain.

The Bottom Line of Supply Chain Resiliency

Without question, developing supply chain resiliency is essential in 2024. But doing so is not without costs, both literally and figuratively.

It takes an investment of time and budget to develop and implement an array of resiliency strategies. These strategies may include dual sourcing (also known as multisourcing) to manage risk, reshoring or nearshoring to better control the supply chain, ensuring capacity buffers to better manage inventory, and implementing best-practice policies to optimize processes.

Here at MES, we put a lot into creating successful and mutually beneficial partnerships, which is why our value-added services are specifically designed to help ensure supply chain resiliency. From tooling design to quality processes to inventory management to JIT shipping to tariffs, compliance, and supply chain disruption mitigation, MES can help you create a robust global supply chain for your parts and components.

Of course, we hope you decide to partner with us, so we invite you to contact us to talk about what it means to build a resilient, next-generation supply chain.

But even if you don’t choose MES, we want you to be well-informed about the factors impacting shipping around the world and what it means for supply chain. Take a look at these additional global supply chain resources to learn more:

Shifting Your Supply Chain Strategy to Align with the New Normal